estate and gift tax exemption sunset

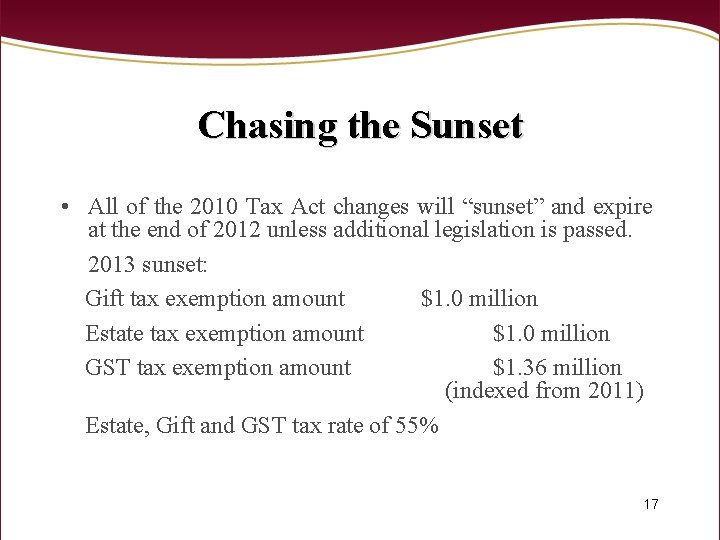

Fortunately the IRS has answered this question. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year.

Sunrise Sunset The Federal Estate Tax Is Back

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information.

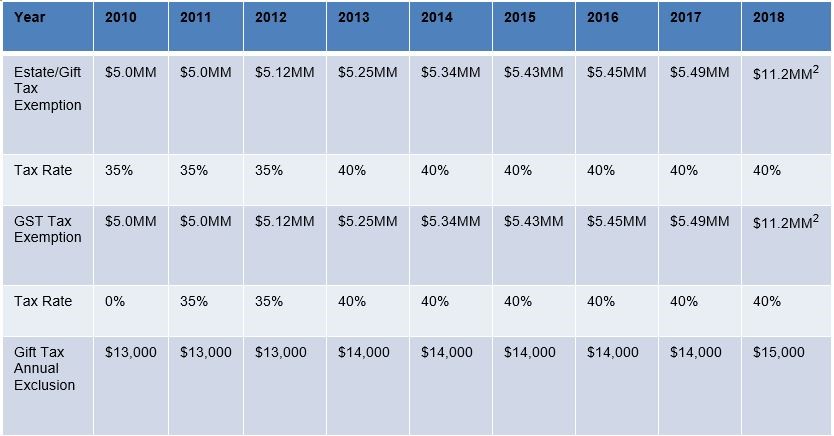

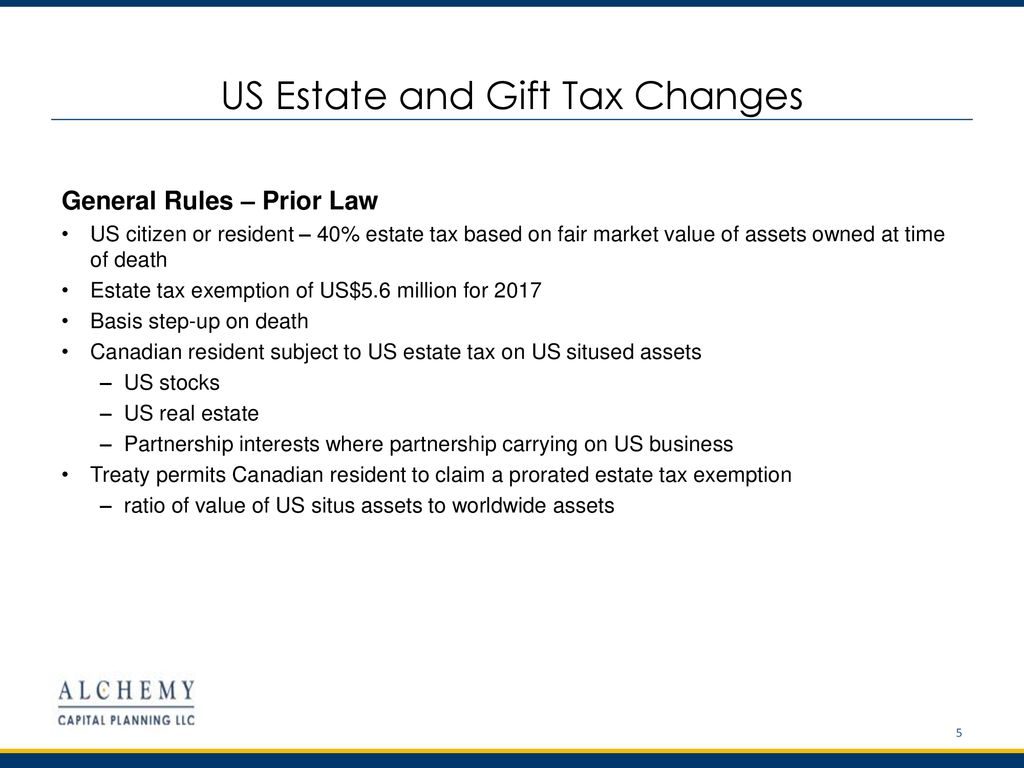

. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom. Said another way you should keep reading if your estate value exceeds 11580000 5790000 if unmarried.

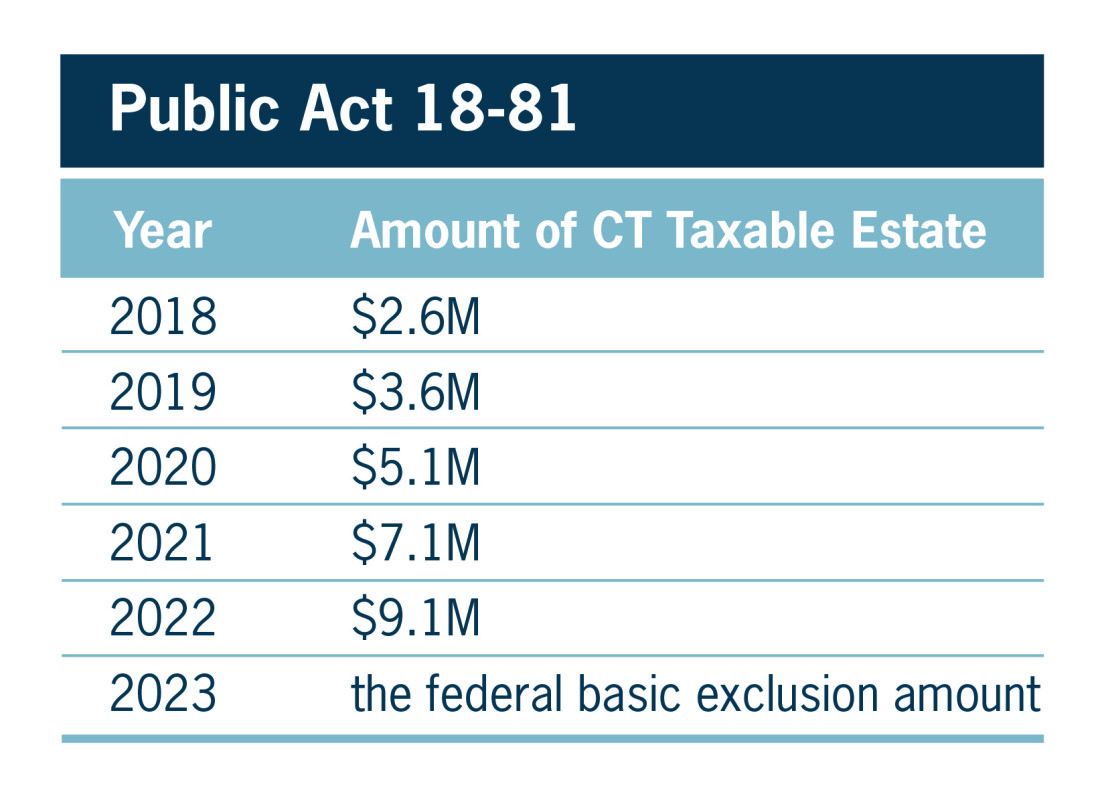

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The Tax Cuts and Jobs Act TCJA of 2017 introduced major changes to the tax system including an approximate doubling of the unified lifetime exemption of assets that can be passed to recipients free from gift and estate taxes. The New Jersey Estate Tax was phased out in two parts.

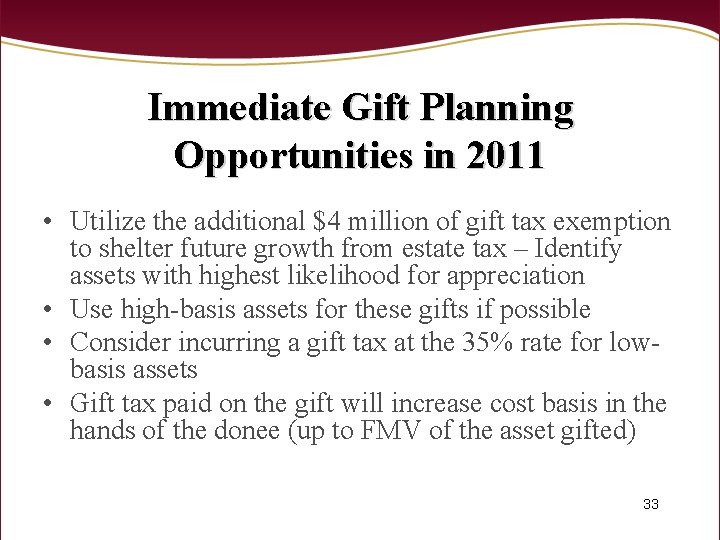

Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after- tax assets rather than 1964 million if you made the gift sooner. On December 31 2016 or before the Estate Tax exemption was capped at 675000.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. It sunsets at the end of 2025 when it will be reduced by half. You can gift up to the exemption amount during life.

Under the current law this increased exemption will sunset at the end of December 31 2025 to 5 million per person adjusted for inflation. You can gift up to the exemption amount during life or at death or some combination thereof tax-free. The unified lifetime exemption for 2017 was 5490000 per taxpayer meaning that an individual could make gifts during life pass assets at.

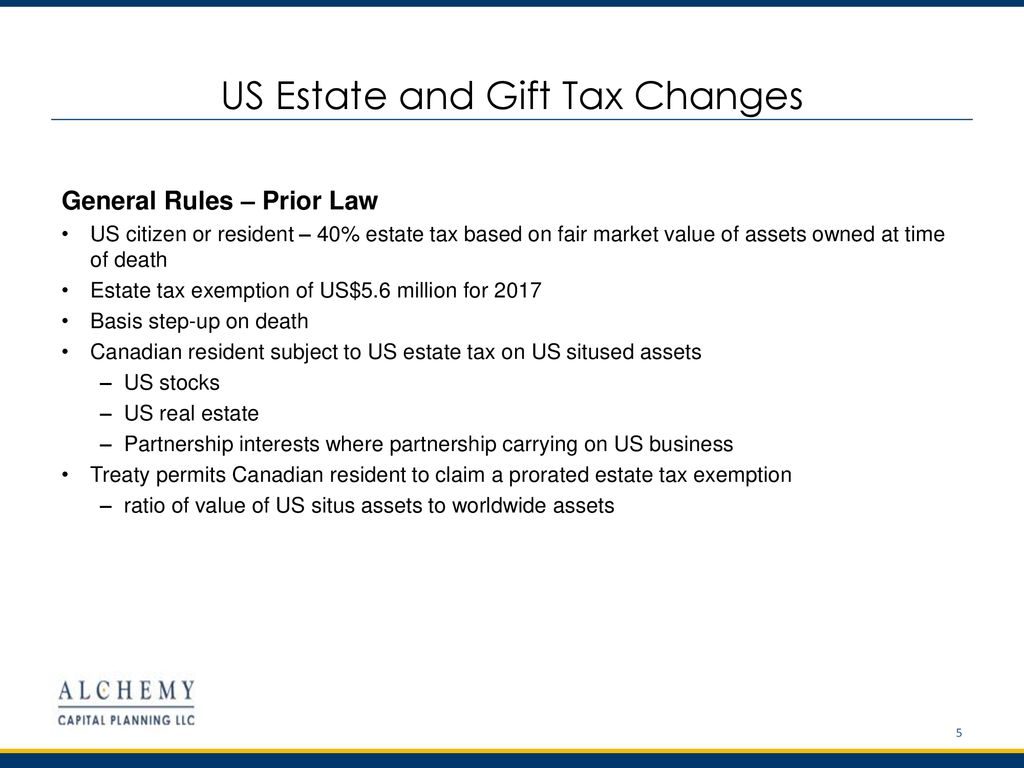

An estate paid only the higher of the two. The exemption on the sunset date is expected to be somewhere between 6 million and 7 million per person but there have been. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

While it is possible that Congress could vote to extend them we need to assume at this time that the increased exemptions will go back to their previous levels. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025.

If the resident decedent died. As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued. Under current law the estate and gift tax exemption is 117 million per person.

Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the current tax-free gift limit when you die. Under current law the estate and gift tax exemption is 117 million per person.

Thats because the increase in the exemption is due to sunset as of January 1 2026 meaning that estate gift and generation-skipping transfer tax exemptions will return to their pre-2018 levels. Note that provisions within the TCJA impacting federal gift and estate taxes will sunset after 2025. Now is the time for estate planning preparations for 2022 and beyond says a recent article titled The State of Estate Planning 2022.

How Gift Taxes Work The annual gift tax exclusion is 16000 in 2022. The federal per person lifetime exemption for estate and gift tax for 2022 is now 12060000. In New Jersey the Inheritance Tax was a credit against the Estate Tax.

The IRS issued proposed regulations Tuesday REG-118913-21 that would provide an exception to the anti-clawback special rule that preserves the benefits of the temporarily higher gift and estate basic exclusion amountThe regulations would apply to certain transfers that are includible or treated as includible in a decedents gross estate under Sec. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the threshold has been cut in half. TCJA doubled the estate and gift tax exemption to 112 million for single filers 224 million for couples and continued to index the exemption levels for inflation.

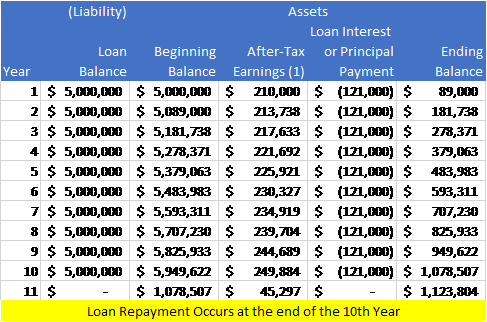

Estate and gift tax. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted numbers. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Key estate tax figures for 2022 Unified estate and gift tax exemption 1206 millionindividual. The exemption amount gets adjusted each year and if no change in the law is made it will increase to approximately 12060000 in 2022.

Assume that a taxpayer with a net worth of 12000000 gives an 11000000 note to his or her children and files a gift tax return showing use of 11000000 of his or her 12060000 estate tax. On or after January 1 2017 but before January 1 2018 the. This means that if Congress does not take action before then federal gift and estate tax law will generally revert to rules in place in 2017.

In 2020 the gift and estate tax exemption is 1158 million per person. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. With inflation this may land somewhere around 6 million.

The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples. This is the highest the exemption has ever been.

High Net Worth Families Should Review Their Estate Plans Pre Election

Federal Estate Tax Exemption Sunset Is Not Far Off Merhab Robinson Clarkson Law Corporation

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Sunrise Sunset The Federal Estate Tax Is Back

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

The Jewish Community Foundation Ppt Download

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The Generation Skipping Transfer Tax A Quick Guide

Will The Lifetime Exemption Sunset On January 1 2026 Agency One